Captive Insurance Companies

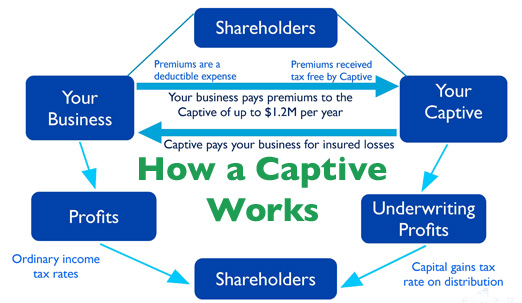

Bringing the benefits of captive insurance to your world.Your business insurance policies have gaps, limits, exclusions and other risk retentions that a captive insurance company could cover. A captive insurance company is a company that you own and that issues coverage for specific risks to your business.

Many business owners diversify and segregate income in related entities. The operating company receives a deduction and the related company recognizes income in return for the product or service it provides, even though they share similar ownership.

Consider a captive to be like any other business to which a related company can pay for a product or service, but with a distinct difference – the captive does not immediately recognize the income it receives, so that it may build surpluses.